Planned Giving

Apply TodayThe term planned giving is commonly used to describe gifts legally provided for by a donor which is part of his/her overall estate plan. Such contributions are made in the form of a will, insurance policy, or trust.

A planned gift (sometimes called a deferred gift) is a charitable contribution that takes into account the donor’s personal tax, financial, and estate circumstances and goals. It can be made during the donor’s life or after their death.

Leave behind your legacy by sharing in the mission of Holy Cross High School as it continues to educate and minister to young men and women. By helping Holy Cross with a bequest or trust, you will leave your mark on the lives of future Holy Cross men and women.

There are many ways you can make a contribution to the mission of the school. Some of the Planned Giving vehicles can be a creative tool for making a gift to Holy Cross High School while also maximizing benefits both to you and the school. As you meet with your financial planner, they will know that Planned Giving can offer great tax savings and, at the same time, it may even provide an income flow to you for life. Scholarships, financial aid, operating funds, building funds—all are part of the Holy Cross legacy, and you can help us continue and strengthen our mission through various forms of estate planning.

Please know that Planned Gifts of all sizes are welcome and appreciated. Some ways to share in the Mission of Holy Cross:

Give a Charitable Bequest

Include a provision in your will or trust for the benefit of Holy Cross to ensure that its mission continues for years to come. A bequest is easy to arrange, reduces your taxable estate, and allows you to retain your assets throughout your lifetime. The flexibility of a bequest permits you to designate a specific dollar amount, percentage of your estate, or a parcel of property. If you are considering a bequest to Holy Cross, we recommend that you consult a lawyer who specializes in trusts and estates.

Life Insurance

Name Holy Cross as the beneficiary of all or part of your life insurance policy. When you make Holy Cross the beneficiary of the policy, you may be eligible for an income-tax charitable deduction. Proceeds from the policy are completely removed from the taxable estate of the donor.

Charitable Remainder Trusts

This is a flexible plan allowing you to receive immediate income tax deduction. Gifts to a Charitable Remainder Trust are usually in the form of appreciated stock or property, whose sale would incur a capital gains tax. A Charitable Remainder Trust is established when a donor places cash, stock, real estate, or art valued over $100,000 into a trust. The trust pays you or your beneficiaries a percentage based on the value of the assets. The assets pass to Holy Cross when the trust ends.

Charitable Lead Trusts

A Lead Trust is the opposite of the Charitable Remainder Trust. The benefits include transferring assets to your heirs and maximizing tax savings. You place a gift in a “lead” trust. The trust makes payments to Holy Cross for a specific period of time. When the trust ends, remaining assets go to your beneficiaries with reduced tax liabilities.

Create a Permanent Honor Gift or Memorial

Create a Permanent Honor or Memorial for a loved one by making a gift of $5,000 or more in their honor or memory. The names of those enrolled will be listed each year in the Annual Report.

When you include a provision in your will or trust for the benefit of Holy Cross, you provide essential resources that will shape the future of the school and ensure its excellence for generations to come. If one of these strategies seems right for you, contact the Advancement Office at Holy Cross at (718) 886-7250 or advancement@holycrosshs.org. See below:

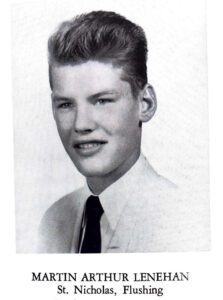

Upon his passing to his eternal reward, Martin A. Lenehan ‘59, honored his alma mater by bequeathing $1,000,000 from his estate to Holy Cross. He had earlier created a fund in his name to provide students with tuition assistance. He requested that the new fund be named the

Upon his passing to his eternal reward, Martin A. Lenehan ‘59, honored his alma mater by bequeathing $1,000,000 from his estate to Holy Cross. He had earlier created a fund in his name to provide students with tuition assistance. He requested that the new fund be named the

Martin A. Lenehan and Mary J. Lenehan Endowment

Each year the Holy Cross High School Committee on Financial Aid reviews the results of the applications made by students through FAIR. In order to support students who might not otherwise be able to benefit from a Holy Cross education, the committee provides many with financial aid. It is from the annual earnings of such funds as those created by Martin A. Lenehan ‘59 that tuition assistance grants and financial aid are provided.